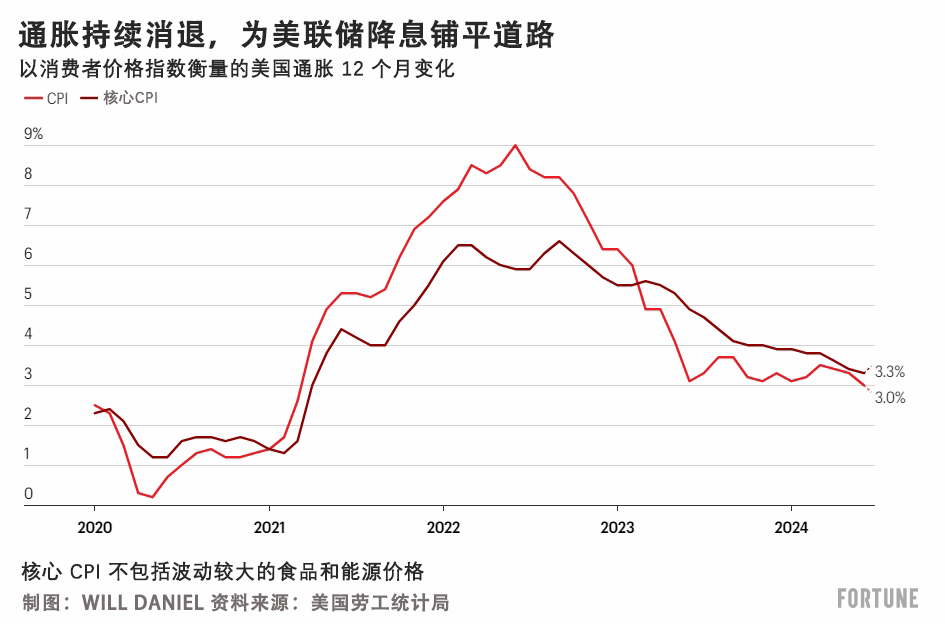

在经受了连续好几年的物价上涨后,美国人民终于可以暂时松一口气了。根据美国劳工统计局上周四发布的CPI报告,今年6月份,美国通胀率较上月下降了0.1%,甚至还要优于分析师们普遍预测的正增长0.1%。和去年同期相比,消费价格也仅上涨了2.97%,是三年多以来涨幅最小的一次。

针对美国6月份的CPI数据,GW&K投资管理公司的全球策略师比尔·斯特林认为:“人们普遍预期这将是一份乐观的报告。不过正如你所看到的那样,它甚至还要好于预期。”

6月份美国CPI下降的主要因素是汽油价格下跌3.8%。但与此同时,美国的核心通胀率(即不包括价格波动较大的食品和能源价格)也低于预期。由于房价涨幅放缓,6月份美国的核心通胀率仅环比上涨0.06%,较去年同期上涨约3.3%,也创下了近三年来的新低。

近年来,美联储一直在使用高利率政策对抗通胀。长期以来,专业投资者们也一直认为,美联储的加息战术一定能把通胀率打下来,结果却是一次又一次被打脸。但这一次,许多专家坚信,美联储终于将通胀控制住了,而美联储的降息令也不远了。

“总而言之,从美联储的角度来看,这是一份非常鼓舞人心的报告。市场现在非常确信,美联储有可能将在9月份启动降息。”斯特林说。

为什么说美联储将降息

6月份的CPI报告公布后,整个华尔街都弥漫着乐观的情绪。花旗银行经济学家维罗妮卡·克拉克指出,市场对6月份的通胀预期已经放得很低了,但是实际通胀率却还要低于预期,这表明今年一季度的高通胀很可能是一种“反常现象”。克拉克在每周四写给客户的一份报告中指出,随着房价涨幅逐渐回落,美联储应该有可能在9月底前启动降息。

多年来,房价上涨一直是美联储主席杰罗姆·鲍威尔的一块心病。不过包括沃顿商学院的杰里米·西格尔在内的很多经济学家都认为,美联储的衡量指标是有一定滞后性的,现实是美国的房价和租金增长已经在降温了。

Bancreek资本顾问公司的首席分析官埃里克·帕切曼认为,目前,这些滞后的衡量指标与当前房价已经趋于一致。这一点是至关重要的,因为仅房价的涨幅就占到了CPI指数的三分之一。“我们终于有了至少一个可以作为锚点的数据点。可能我是过度反应了,不过我仍然非常兴奋。”

UBS全球财富管理公司美国高级经济学家布莱恩·罗斯也认同克拉克和帕切曼的乐观看法。他表示,最近失业率数据的上升,也有助于促使美联储官员转向鸽派。他通过电子邮件告诉《财富》:“随着通胀和劳动力市场双双放缓,美联储降息的大门似乎已经敞开了。”

芝加哥商品交易所的“美联储观察”工具显示,从美联储基金的期货合约看(从中可以观察债市投资者预期),在6月份的CPI报告发布后,美联储在7月份启动降息的可能性有所上升,但仍低于 10%。然而美联储在9月降息的可能性,已从上月CPI报告发布后的大约50%,飙升至上周四的98%。而美联储到12月份前至少降息一次的几率已经无比接近100%。

股市为何下跌?

一般情况下,降息是股市的净利好因素。降息意味着借贷成本降低,企业可以更容易地拿到融资,用于企业增长。在上周四的CPI报告发布后,虽然市场预期降息基本已成定局,但美国三大股指却有两个出现了下跌。

首先是蓝筹股标普500指数下跌0.88%,而科技股重镇纳斯达克指数则大跌约1.95%。不过有意思的是,标普500的等权重指数(即不采用市值加权指数)实际上上涨超1.21%。

“是股市下跌了吗?还是我们这次处在一个最极端的大轮转里?”在谈到这些数据时,Bancreek资本顾问公司的帕切曼问道。

他指出,现实情况是,上周四多数股票都没有下跌。不过在过去两年里让投资者最为疯狂的大型科技股和与人工智能概念股确实有所下跌。不过这并非大盘全面下行,而是投资者转向了更注重价值的股票——这也是大势所趋。

比如近年来,大型科技股的股价一路飚升,成为市场集中度最高的板块之一。上周四,大型科技股出现大幅下跌,英伟达下跌5.6%,苹果下跌2.3%,微软下跌2.5%,特斯拉下跌8.4%。

帕克曼并不是唯一一个认为投资者正在转换目标的人。亚登尼研究公司(Yardeni Research)的首席投资官埃里克·沃勒斯坦上周四也在X上发帖称,他认为“大轮转”有可能正在发生。他还指出,上周四,很多投资者从增长导向型的大盘股,转向了价值导向型的中小盘股。

这并非完全是不合逻辑的,因为标普600小型股指数的远期市盈率仅为13.9倍,而大型股标普500指数的远期市盈率超过21倍。而且小盘股的平均负债率远高于大盘股,它们也比大盘股更容易受高利率的影响。但现在这种情况可能正在改变。

小盘股的估值不到8大市值公司的一半。所以稍作轮动是有道理的。https://t.co/HHHMkqPYI9 pic.twitter.com/6MUVITwQB2

——埃里克·沃勒斯坦 (@ericwallerstein) ,2024年7月11日

关于股价下跌(特别是大型科技股和增长型股票),第二个可能的解释是,市场一直拉今年对降息的预期。即使在上周四的下跌以后,标普500指数今年仍上涨约 17%,纳斯达克综指更是借人工智能热潮飙升了约 23%。

GW&K投资公司的斯特林表示:“股市已经持续上涨了很长时间,所以我可以说,好消息已经被炒作了很久了。”

斯特林认为,通胀下降未必是一件令人意外的事,尤其是很多价格上涨很快的商品类别已经出现了大幅降价。因此,很多投资者在对股票进行估值时,可能已经把降息因素考虑了进去。以木材为例,木材期货价格较2021年的峰值已经下跌了75%以上。再比如二手车的全国平均价格也从2022年峰值的30000多美元跌至25328美元。

总而言之,也许上周四,股民们只是再次遵循了华尔街给新手投资者的一句经典建议:“谣言时买入,证实时卖出。”(财富中文网)

译者:朴成奎

在经受了连续好几年的物价上涨后,美国人民终于可以暂时松一口气了。根据美国劳工统计局上周四发布的CPI报告,今年6月份,美国通胀率较上月下降了0.1%,甚至还要优于分析师们普遍预测的正增长0.1%。和去年同期相比,消费价格也仅上涨了2.97%,是三年多以来涨幅最小的一次。

针对美国6月份的CPI数据,GW&K投资管理公司的全球策略师比尔·斯特林认为:“人们普遍预期这将是一份乐观的报告。不过正如你所看到的那样,它甚至还要好于预期。”

6月份美国CPI下降的主要因素是汽油价格下跌3.8%。但与此同时,美国的核心通胀率(即不包括价格波动较大的食品和能源价格)也低于预期。由于房价涨幅放缓,6月份美国的核心通胀率仅环比上涨0.06%,较去年同期上涨约3.3%,也创下了近三年来的新低。

近年来,美联储一直在使用高利率政策对抗通胀。长期以来,专业投资者们也一直认为,美联储的加息战术一定能把通胀率打下来,结果却是一次又一次被打脸。但这一次,许多专家坚信,美联储终于将通胀控制住了,而美联储的降息令也不远了。

“总而言之,从美联储的角度来看,这是一份非常鼓舞人心的报告。市场现在非常确信,美联储有可能将在9月份启动降息。”斯特林说。

为什么说美联储将降息

6月份的CPI报告公布后,整个华尔街都弥漫着乐观的情绪。花旗银行经济学家维罗妮卡·克拉克指出,市场对6月份的通胀预期已经放得很低了,但是实际通胀率却还要低于预期,这表明今年一季度的高通胀很可能是一种“反常现象”。克拉克在每周四写给客户的一份报告中指出,随着房价涨幅逐渐回落,美联储应该有可能在9月底前启动降息。

多年来,房价上涨一直是美联储主席杰罗姆·鲍威尔的一块心病。不过包括沃顿商学院的杰里米·西格尔在内的很多经济学家都认为,美联储的衡量指标是有一定滞后性的,现实是美国的房价和租金增长已经在降温了。

Bancreek资本顾问公司的首席分析官埃里克·帕切曼认为,目前,这些滞后的衡量指标与当前房价已经趋于一致。这一点是至关重要的,因为仅房价的涨幅就占到了CPI指数的三分之一。“我们终于有了至少一个可以作为锚点的数据点。可能我是过度反应了,不过我仍然非常兴奋。”

UBS全球财富管理公司美国高级经济学家布莱恩·罗斯也认同克拉克和帕切曼的乐观看法。他表示,最近失业率数据的上升,也有助于促使美联储官员转向鸽派。他通过电子邮件告诉《财富》:“随着通胀和劳动力市场双双放缓,美联储降息的大门似乎已经敞开了。”

芝加哥商品交易所的“美联储观察”工具显示,从美联储基金的期货合约看(从中可以观察债市投资者预期),在6月份的CPI报告发布后,美联储在7月份启动降息的可能性有所上升,但仍低于 10%。然而美联储在9月降息的可能性,已从上月CPI报告发布后的大约50%,飙升至上周四的98%。而美联储到12月份前至少降息一次的几率已经无比接近100%。

股市为何下跌?

一般情况下,降息是股市的净利好因素。降息意味着借贷成本降低,企业可以更容易地拿到融资,用于企业增长。在上周四的CPI报告发布后,虽然市场预期降息基本已成定局,但美国三大股指却有两个出现了下跌。

首先是蓝筹股标普500指数下跌0.88%,而科技股重镇纳斯达克指数则大跌约1.95%。不过有意思的是,标普500的等权重指数(即不采用市值加权指数)实际上上涨超1.21%。

“是股市下跌了吗?还是我们这次处在一个最极端的大轮转里?”在谈到这些数据时,Bancreek资本顾问公司的帕切曼问道。

他指出,现实情况是,上周四多数股票都没有下跌。不过在过去两年里让投资者最为疯狂的大型科技股和与人工智能概念股确实有所下跌。不过这并非大盘全面下行,而是投资者转向了更注重价值的股票——这也是大势所趋。

比如近年来,大型科技股的股价一路飚升,成为市场集中度最高的板块之一。上周四,大型科技股出现大幅下跌,英伟达下跌5.6%,苹果下跌2.3%,微软下跌2.5%,特斯拉下跌8.4%。

帕克曼并不是唯一一个认为投资者正在转换目标的人。亚登尼研究公司(Yardeni Research)的首席投资官埃里克·沃勒斯坦上周四也在X上发帖称,他认为“大轮转”有可能正在发生。他还指出,上周四,很多投资者从增长导向型的大盘股,转向了价值导向型的中小盘股。

这并非完全是不合逻辑的,因为标普600小型股指数的远期市盈率仅为13.9倍,而大型股标普500指数的远期市盈率超过21倍。而且小盘股的平均负债率远高于大盘股,它们也比大盘股更容易受高利率的影响。但现在这种情况可能正在改变。

小盘股的估值不到8大市值公司的一半。所以稍作轮动是有道理的。https://t.co/HHHMkqPYI9 pic.twitter.com/6MUVITwQB2

——埃里克·沃勒斯坦 (@ericwallerstein) ,2024年7月11日

关于股价下跌(特别是大型科技股和增长型股票),第二个可能的解释是,市场一直拉今年对降息的预期。即使在上周四的下跌以后,标普500指数今年仍上涨约 17%,纳斯达克综指更是借人工智能热潮飙升了约 23%。

GW&K投资公司的斯特林表示:“股市已经持续上涨了很长时间,所以我可以说,好消息已经被炒作了很久了。”

斯特林认为,通胀下降未必是一件令人意外的事,尤其是很多价格上涨很快的商品类别已经出现了大幅降价。因此,很多投资者在对股票进行估值时,可能已经把降息因素考虑了进去。以木材为例,木材期货价格较2021年的峰值已经下跌了75%以上。再比如二手车的全国平均价格也从2022年峰值的30000多美元跌至25328美元。

总而言之,也许上周四,股民们只是再次遵循了华尔街给新手投资者的一句经典建议:“谣言时买入,证实时卖出。(财富中文网)

译者:朴成奎

After years of struggling with the rising cost of living, Americans are finally getting some minor relief. U.S. inflation fell 0.1% month-over-month in June, beating analysts’ consensus forecast for an 0.1% rise, the Bureau of Labor Statistics reported Thursday. On an annual basis, consumer prices also rose just 2.97%—the smallest jump in over three years.

“Expectations were that this was going to be a good report. But as you can see, it was better than expected,” Bill Sterling, global strategist at GW&K Investment Management, told Fortune of the consumer price index (CPI) data.

A 3.8% dip in gasoline prices was responsible for much of the drop in inflation during June, but core inflation, which excludes more volatile food and energy prices, also came in cooler than anticipated. Slowing shelter price increases led core inflation to rise just 0.06% month-over-month, and roughly 3.3% from a year ago—another three-year low.

After years of the Federal Reserve fighting inflation with relatively high interest rates, professional investors have long been predicting the central bank would win in its battle against rising prices, only to be disappointed time and again. But this time, many experts are convinced that the Fed has finally tamed inflation, and interest rate cuts are on the way.

“All in all, it was a very encouraging report from the point of view of the Fed. And markets are pretty convinced now that this tees up a Fed rate cut in September,” Sterling said.

Why you should expect rate cuts

The optimistic outlook after the CPI report was evident across Wall Street. Citi economist Veronica Clark noted that inflation came in “below already soft expectations” in June, signaling the hotter-than-expected inflation seen in the first quarter was likely “an aberration.” Now, particularly with shelter inflation fading, the Fed should have the green light to cut rates by September, Clark argued in a Thursday note to clients.

Shelter inflation has been a thorn in the side of Fed chair Jerome Powell for years, but throughout that period, a number of analysts and economists including Wharton’s Jeremy Siegel have noted that the Fed’s measurements tend to lag the reality on the ground, where home and rent price growth has cooled.

Eric Pachman, chief analytics officer at Bancreek Capital Advisors, believes we’re now finally seeing evidence that the lagging shelter metric is moving more in line with current prices. That’s critical because shelter inflation alone accounts for roughly one-third of the consumer price index. “We finally have at least one data point to hang our hat on. So, maybe I'm overreacting, but I'm pretty excited,” he said of the shelter inflation data.

Brian Rose, senior U.S. economist at UBS Global Wealth Management, echoed Clark and Pachman’s optimistic comments, while adding that the recent rise in the unemployment rate could also provide more ammunition for Fed officials to turn dovish. “With both inflation and the labor market softening, the door now appears wide open for the Fed to begin cutting rates,” he told Fortune via email.

The probability of a July interest rate cut based on Fed funds futures contracts—which provide insight into bond market investors’ expectations—rose after the CPI report, but remains under 10%, according to CME’s FedWatch tool. However, the odds of a September cut have soared from roughly 50% after last month’s CPI report to 98% on Thursday. And by December, the odds of at least one rate cut are sitting at nearly 100%.

Why are stocks down?

Typically, interest rate cuts are seen as a net positive for stocks. Lower rates signal lower borrowing costs, which means more money for companies to invest in their growth. But after the cool CPI report Thursday, which signaled rate cuts are more likely than ever, two out of three major indices fell.

The blue chip S&P 500 sank 0.88%, while the tech-heavy Nasdaq plummeted roughly 1.95%. But interestingly, an equal-weighted version of the S&P 500—one that doesn’t bias exposure to companies based on their market cap—actually rose more than 1.21%.

“Is the market down? Or is this the most extreme rotation that we've ever seen out of everything that people have been hiding in?” Bancreek Capital Advisors’s Pachman asked when faced with this data.

The reality is, most stocks didn’t fall on Thursday, he noted, but the big tech and AI-linked stocks that have made investors euphoric over the past two years sure did. This is not a broad-based stock market drop for now, it’s an investor rotation into more value-focused offerings—one that’s long been predicted.

To that point, shares of big tech leaders, which have soared in recent years leading to one of the most concentrated markets in history, fell sharply on Thursday. Nvidia was down 5.6%, while Apple sank 2.3%, Microsoft fell 2.5%, and Tesla dropped 8.4%.

Pachman wasn’t alone in his investor rotation diagnosis. Eric Wallerstein, chief investment officer at Yardeni Research, said that he believes “the great rotation” may be underway in a post on X (formerly Twitter) Thursday. Wallerstein noted that investors shifted away from growth-focused large caps and into mostly value-oriented small- and mid-caps en masse on Thursday.

That’s not entirely illogical, given that the S&P 600 small cap index is trading at just 13.9 times forward earnings, while the large cap S&P 500 index is trading at over 21 times forward earnings. Small caps, which have far more debt on average than their large cap peers, have suffered under a higher-rate regime, but that could be changing.

small caps were trading at less than half the valuation of the mega-cap 8. A little rotation makes sense. https://t.co/HHHMkqPYI9 pic.twitter.com/6MUVITwQB2

— Eric Wallerstein (@ericwallerstein) July 11, 2024

The second possible explanation for the pain in stocks after the bullish CPI report, particularly big tech and growth stocks, is simply that the market has been rallying in anticipation of rate cuts throughout 2024. Even after its Thursday drop, the S&P 500 is still up roughly 17% year-to-date, and the Nasdaq Composite has soared around 23% amid the AI boom.

“Stocks have been on such a tear for such a long time, you could argue that [the] good news was already baked in the cake,” Sterling, of GW&K Investments, explained.

To his point, it’s not necessarily surprising that inflation is coming down, particularly with so many once-red hot price categories falling sharply. And that means many investors have likely been pricing in falling rates when valuing stocks. Take lumber, for example, where futures prices are down more than 75% from their 2021 peak. Or used cars, where the average price nationwide is down from its 2022 peak of over $30,000 to just $25,328.

At the end of the day, maybe market participants just listened to the classic Wall Street line given to rookie investors on Thursday: Buy the rumor, sell the news.